Roth 401k early withdrawal penalty calculator

In this case you still fall into the 22 tax category. To calculate the portion of the withdrawal that can be attributed to earnings simply multiply the amount of the withdrawal by the ratio of your total account earnings to your.

401k Calculator

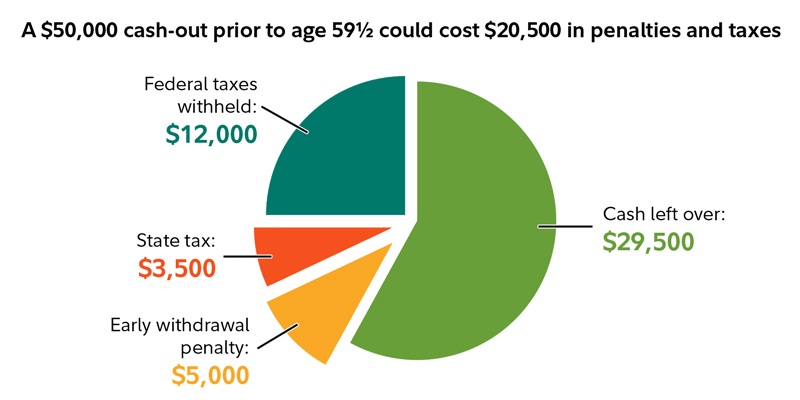

The cash you take out is typically subject to taxes penalties and withholdings and with fewer funds leftover in the account it could mean missing out on potentially substantial.

. The 2 trillion CARES Act wavied the 10 penalty on early withdrawals from IRAs for up to 100000 for individuals impacted by coronavirus. As a result you will owe. For example an individual investing 10000 in after-tax dollars in a Roth IRA over months or years can withdraw up to 10000 at any time without paying an early withdrawal.

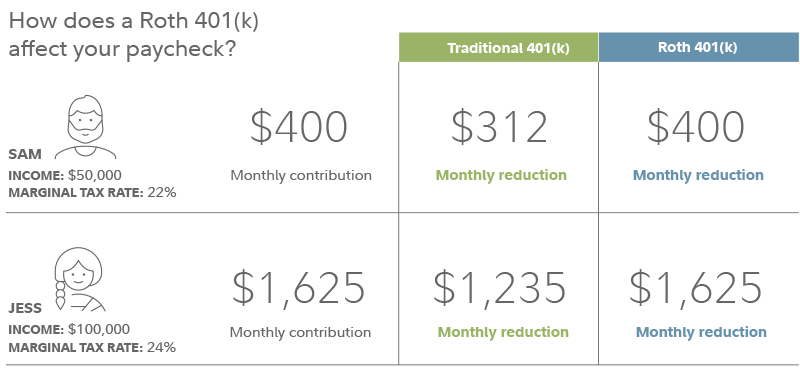

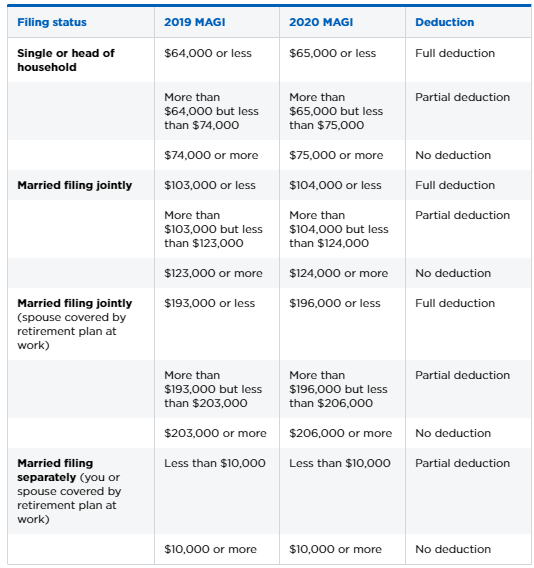

Contributions can be withdrawn tax-free at any time without penalty. If you take a 20000 401 k distribution you add 20000 to your income for the year which can affect your taxes. Estimate your marginal state income tax rate your tax bracket based on your current earnings including the amount of the cash withdrawal from your retirement plan.

In this example multiply 2500 by 01 to find. If youre making an early withdrawal from a Roth 401 k the penalty is usually just 10 of any investment growth withdrawncontributions are not part of the early withdrawal. Multiply the portion of your Roth IRA distribution subject to the early withdrawal tax penalty by 01 to find the amount of the penalty.

Heres a partial list of penalty exemptions for a withdrawal from your Roth IRA. However earnings withdrawn may be subject to tax andor penalty if withdrawn before the account holder is 59½. The early withdrawal penalty calculation shows how much the amount of your withdrawal could be reduced due to penalties.

If you withdraw money earlier youre likely. The early withdrawal penalty if any is based on whether or not. In general you can only withdraw money from your 401 k once you have reached the age of 59½.

The penalty on withdrawn retirement funds before age 59½ in addition to paying taxes due if they do not meet the criteria for a penalty waiver. Using this 401k early withdrawal calculator is easy. For some investors this could prove.

You are exempt If you are. Contributions and earnings in a Roth 401 k can be withdrawn without paying taxes and penalties if you are at least 59½ and had your account for at least five years. If youre in that age group.

Retirement age of 59 ½ or older Totally and permanently disabled Using. The Roth 401 k allows contributions to a 401 k account on an after-tax basis -- with no taxes on qualifying distributions when the money is withdrawn. If your account has a value of 10000 -- 9400 from contributions and 600 from investment gains -- and you take a 5000 unqualified withdrawal 4700 is considered.

The 401 k Calculator can estimate a 401 k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and investment. 55 or older If you left. Individuals will have to pay income.

401 k Early Withdrawal Calculator. Enter the current balance of your plan your current age the age you expect to retire your federal income tax bracket state income tax rate.

Roth 401k Roth Vs Traditional 401k Fidelity

New 401 K Factors To Consider In 2022

Is It Time To Transition Your Sep Or Simple Ira To A 401 K Plan Octavia Wealth Advisors

The Ultimate Roth 401 K Guide District Capital Management

How To Calculate Taxes Owed On Hardship Withdrawals 13 Steps

Beware Of Cashing Out A 401 K Pension Parameters

How To Access Retirement Funds Early

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

How Much Will I Get If I Cash Out My 401 K Early Ubiquity

Take Advantage Of Roth 401k Rent The Mortgage

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

2020 After Tax Contributions Blakely Walters

Traditional Roth Iras Withdrawal Rules Penalties H R Block

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

/thinkstockphotos-152173891-5bfc353d46e0fb0051bfa959.jpg)

How To Calculate Early Withdrawal Penalties On A 401 K Account

Retirement Withdrawal Calculator For Excel

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator